Money Matters! Lacresha White Explains Why

Lacresha White, Frostburg State University

What happens when you put former foster youth in a room full of foster care professionals?

Education…but the “teacher” may surprise you.

On Nov. 17, 2014, the Child Welfare League of America hosted “Financial Challenges Facing Youth in Transition,” a panel discussion about how to create policies and practices to help foster youth with money management.

And while professionals from a variety of organizations swapped ideas and best practices, two unique people helped shed light on the struggles of stepping out of the foster care system, and blindly, stepping in to a world driven by finances.

FC2S student and 2014 Aim Higher Fellow, Lacresha White, and R.J. Tilley, an Our House alumnus, both shared their ups and downs when learning to manage money.

Read on to discover why Lacresha felt the need to tell her story to industry professionals, what she hopes they took away after listening and what she believes every young person should learn about money management.

1.Why did you agree to speak at this event?

I’m strongly passionate about being an advocate for foster youth and all the challenges that we face. I feel people hear the challenges but they’re not fully understanding how they can implement ways to help us in their practices.

2. Explain the value of foster care professionals hearing your experiences.

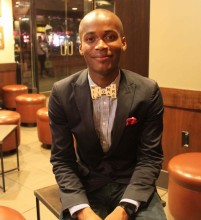

Richard Bienvenue of Our House talks with Lacresha White

I think people learn from others’ experiences; you have to see it firsthand. So if you’re hearing it from someone who never experienced it, you’re not going to learn very much.

It’s also about building that empathy; when you hear a story you’re right there with them and you’re feeling how they felt in that situation.

3. You’re 18 and about to exit foster care. When it comes to money management, what are the top four things you need to know?

How to:

- Open a bank account: You receive ETV funds, scholarships, grants and/or a refund check that you’ll need to safely put away. Also, you will start a job and get a paycheck, which should be saved.

- Build your credit: We will all need credit at some point in the future. (ex. Buying a car, renting an apartment, turning on your utilities)

- Maintain your credit: The higher your credit score the better.

- Budget and don’t overspend your money: We aren’t used to receiving a lump sum of money in foster care; so, it’s important that we understand how to budget and not immediately spend every dime.

4. What are some of the main things you hope professionals took away from your discussion about financial challenges facing foster youth?

I hope that they learned that it’s not just about having the supply of resources available for foster youth; it’s also about meeting them where they are and understanding all the different dynamics of what’s going on today and what we need to learn. Professionals must be able to put that into a course or workshop that actually tailors to a foster youth’s level and present state at that time.